CarePal Money, India’s first integrated healthcare lending marketplace and a subsidiary of CarePal Group (which also houses medical crowdfunding leader Impact Guru), today announced that it has crossed an annualized disbursement run rate of Rs. 100 Cr within just 24 months of operations.

CarePal Money enables patients to finance both elective and critical treatments through no-cost and low-cost EMI loans, from minor procedures to high-value cases exceeding Rs. 25 lakh, such as cancer care. For hospitals, this means improved elective treatment conversions, faster discharges, and fewer cases of patients leaving mid-treatment due to affordability challenges.

With multiple lender integrations, CarePal Money offers one of the highest approval rates in the industry, higher average ticket sizes, and the ability to fund complex, high-cost treatments often overlooked by traditional NBFCs.

|

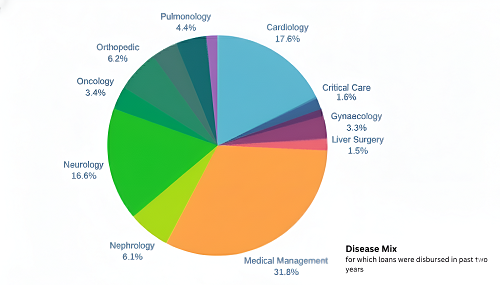

Disease mix – CarePal Money data

Today, CarePal Money’s lending marketplace disbursements span a wide spectrum of treatments: medical management (31.8%), cardiology (17.6%), neurology (16.6%), and orthopedics (6.2%). High-value specialties such as oncology, nephrology, pulmonology, and liver surgery make up a growing share, underscoring how financing is expanding access to both elective and critical care.

“In India, nearly 40% of healthcare costs, i.e., about $45 billion today and projected to exceed $100+ billion by 2030, are still paid out-of-pocket. With rising medical inflation, financing is no longer optional. From a Rs. 100 crore disbursement run rate today, we aim to scale to Rs. 2,000+ crore in the next five years, ensuring no family is denied treatment due to unaffordability,” said Piyush Jain, Co-Founder & CEO, CarePal Group.

“Patients gain access to life-saving treatments at 0% interest, while hospitals reduce dropouts and improve retention. It’s a win-win model for both patients and providers,” said Sahil Lakshmanan, Chief Business Officer, CarePal Money.

Looking ahead, CarePal Money is expanding into tier-2 cities such as Indore and Lucknow, furthering its mission of making affordable healthcare financing accessible nationwide.